Top Guidelines Of Eb5 Investment Immigration

Top Guidelines Of Eb5 Investment Immigration

Blog Article

Unknown Facts About Eb5 Investment Immigration

Table of ContentsAll about Eb5 Investment ImmigrationNot known Facts About Eb5 Investment ImmigrationEb5 Investment Immigration Fundamentals ExplainedNot known Incorrect Statements About Eb5 Investment Immigration Not known Incorrect Statements About Eb5 Investment Immigration

Based upon our latest information from USCIS in October 2023, this two-year sustainment duration starts at the factor when the funding is spent. Nevertheless, the duration can be longer than 2 years for a couple of factors. Initially, the most current upgrade from USCIS does not make clear the time frame in which the capital is considered "spent." Overall, the begin of the duration has been considered the factor when the money is released to the entity in charge of work creation.Discover more: Comprehending the Return of Funding in the EB-5 Process Recognizing the "at threat" requirement is essential for EB-5 capitalists. This concept underscores the program's intent to foster genuine economic activity and work creation in the United States. Although the financial investment features intrinsic threats, mindful project option and conformity with USCIS guidelines can help capitalists attain their goal: permanent residency for the investor and their family members and the ultimate return of their funding.

To become qualified for the visa, you are required to make a minimal investment depending upon your chosen financial investment option. EB5 Investment Immigration. Two financial investment choices are available: A minimal straight financial investment of $1.05 million in an U.S. commercial venture outside of the TEA. A minimal financial investment of a minimum of $800,000 in a Targeted Work Location (TEA), which is a rural or high-unemployment location

The Greatest Guide To Eb5 Investment Immigration

For consular handling, which is done with the National Visa Center, the immigrant visa handling charges payable per individual is $345. If the financier is in the US in a lawful condition, such as an H-1B or F-1, she or he can file the I-485 kind with the USCIS- for changing status from a non-immigrant to that of permanent citizen.

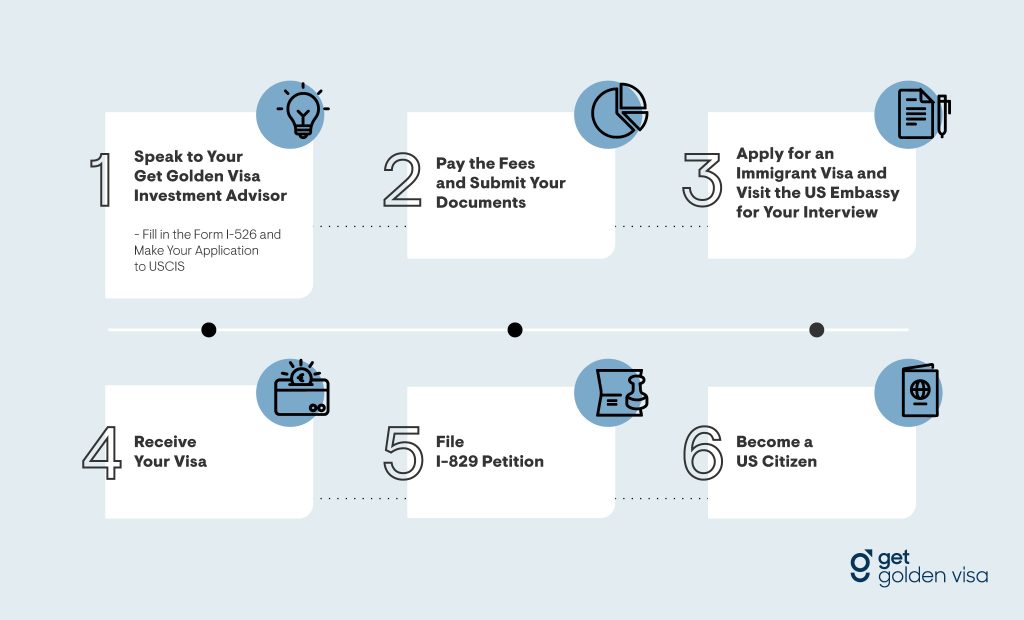

Upon authorization of your EB5 Visa, you get a conditional long-term residency for 2 years. You would require to file a Type I-829 (Petition by Financier to Get Rid Of Conditions on copyright Standing) within the last 3 months of the 2-year validity to get rid of the problems to come to be a long-term local.

As per the EB-5 Reform and Honesty Act of 2022, local center investors should likewise send an extra $1, 000 USD as component of filing their petition. This added article source cost does not use to an amended demand. If you chose the alternative to make a direct financial investment, then you would certainly need to attach an organization strategy together with your I-526.

Eb5 Investment Immigration - Truths

In a straight investment, the financiers structure the investment themselves so there's no additional management cost to be paid. There can be specialist costs borne by the investor to make sure compliance with the EB-5 program, such as lawful fees, service plan composing fees, economic expert charges, and third-party coverage charges among others.

The financier is likewise accountable for getting a service strategy that complies with the EB-5 Visa requirements. This additional cost could vary from $2,500 to $10,000 USD, relying on the nature and structure of business. EB5 Investment Immigration. There can be a lot more costs, if it would certainly be sustained, for instance, by market research study

An EB5 investor ought to likewise consider tax obligation considerations for the duration of the EB-5 program: Given that you'll come to be a permanent homeowner, you will certainly go through income taxes on your around the world earnings. You need to report and pay taxes on any type of earnings received from your investment. If you offer your financial investment, you might undergo a resources gains tax.

10 Simple Techniques For Eb5 Investment Immigration

If you're planning to buy a regional facility, you can seek ones that have reduced fees yet still a high success price. browse around here This makes sure that you pay out less cash while still having a high possibility of success. While employing a legal representative can add to the prices, they can assist reduce the general prices you need to pay in the future as lawyers can make certain that your application is total and accurate, which reduces the opportunities ofcostly mistakes or hold-ups.

Our Eb5 Investment Immigration Diaries

The areas outside of cosmopolitan statistical locations that qualify as TEAs in Maryland are: Caroline Area, Dorchester Region, Garrett Area, Kent Region and Talbot County. The Maryland Department of Commerce is the designated authority to license areas that certify as high joblessness areas in Maryland according to 204.6(i). Business accredits geographic locations such as areas, Demographics designated areas or demographics tracts in non-rural regions as areas of high joblessness if they have unemployment prices of at the very least 150 percent of the national unemployment rate.

We assess application requests to license TEAs under the EB-5 Immigrant Investor Visa program. EB5 Investment Immigration. Demands will certainly be assessed on a case-by-case basis and letters will be released for areas that satisfy the TEA demands. Please examine the actions listed below to identify if your proposed task remains in a TEA and comply with the directions for requesting a qualification letter

Report this page